capital gains tax proposal washington state

Washington does not have a corporate income tax but does levy a gross receipts tax. Washington does not have a typical individual income tax but does levy a 70 percent tax on capital gains income.

How High Are Capital Gains Taxes In Your State Tax Foundation

Washington has a 650 percent state sales rate a max local sales tax rate of 400 percent and an average combined state and local sales tax rate.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Vqt Bell The Cat Job Creation

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2022 Capital Gains Tax Rates In Europe Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

What S In The Democrats Tax Plan Increases In Capital Gains And Corporate Tax Rates Wsj

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Biden Budget Biden Tax Increases Details Analysis

Challenge To Washington S Capital Gains Tax Can Move Forward Judge Rules The Seattle Times

Biden S Better Plan To Tax The Rich Wsj

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

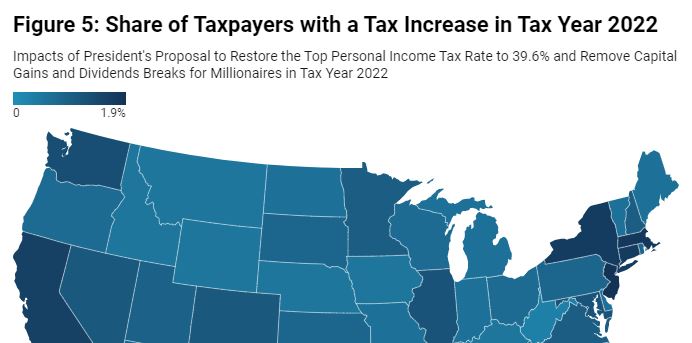

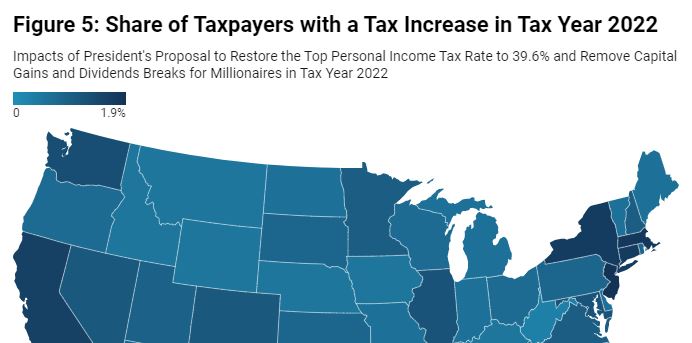

Income Tax Increases In The President S American Families Plan Itep

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Billionaires Tax On Capital Gains Invites Tax Collection Volatility